April 3, 2017 report

Economist suggests US lags in solar cell technology due to investor impatience

(Tech Xplore)—Max Jerneck, an economist with the Stockholm School of Economics, has published an article in the journal Science Advances discussing the current state of solar cell development and sales in the U.S. and why it currently lags so far behind China and Japan. He suggests it is primarily due to investor impatience and a financial climate in which profits are spent on dividends and stock buybacks rather than investment in what many see as risky endeavors.

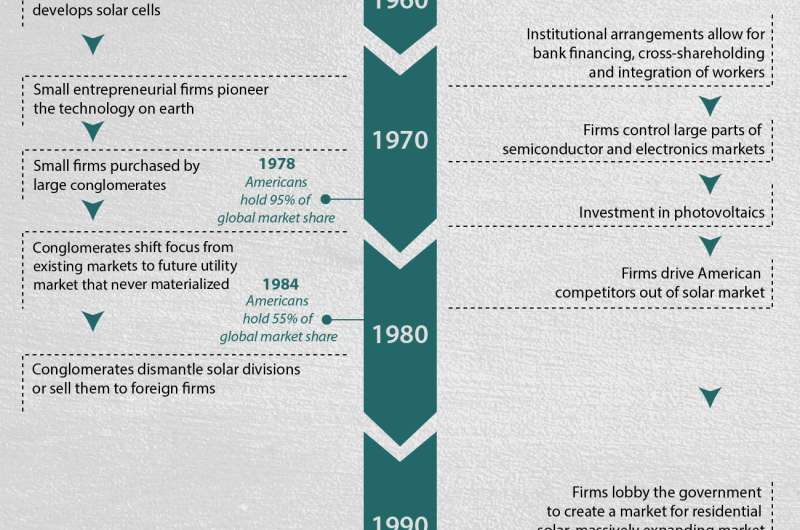

Back in 1970's, the U.S. was the worldwide leader in solar cell development and sales, holding approximately 95 percent of the market. But since that time, the role of the U.S. has declined sharply, down to 55 percent as recently as 1984 and to just 9 percent in 2005. Meanwhile, Japan stepped up its effort, and had roughly half of the market by 2005. Since that time, China has increased its presence dramatically while the U.S. continues to lag. Jerneck investigated the issue, finding that the root cause is a lack of willingness to invest by big money holders.

In the 1970s, investors were big on tech stocks—they made fortunes as companies sprang up seemingly out of nowhere to become overnight sensations, delivering huge amounts of money to those who got in on the ground floor—namely the smart people with the smart ideas and the investors who loaned them the money to get their ideas off the ground. Without such investment, companies like Apple and Microsoft might not be here today. And that is the problem now, Jerneck says—tech investments have become riskier and investors have become less patient—instead of waiting for technology to mature to the point where it becomes profitable, they instead look to the next sure thing so that dividends can be made and stock prices will rise.

That, Jerneck adds, leaves little interest in companies that focus on solar technology. It is a simple formula, he notes: Without capital, technological innovation withers. In the U.S., huge corporations bought most of the early solar startups, and when they did not see immediate profits, sold them to overseas companies. That kind of disinterest continues today, he notes, which suggests it does not appear likely that solar development in the U.S. will rebound any time soon.

More information: Max Jerneck. Financialization impedes climate change mitigation: Evidence from the early American solar industry, Science Advances (2017). DOI: 10.1126/sciadv.1601861

Abstract

The article investigates how financialization impedes climate change mitigation by examining its effects on the early history of one low-carbon industry, solar photovoltaics in the United States. The industry grew rapidly in the 1970s, as large financial conglomerates acquired independent firms. While providing needed financial support, conglomerates changed the focus from existing markets in consumer applications toward a future utility market that never materialized. Concentration of the industry also left it vulnerable to the corporate restructuring of the 1980s, when the conglomerates were dismantled and solar divisions were pared back or sold off to foreign firms. Both the move toward conglomeration, when corporations became managed as stock portfolios, and its subsequent reversal were the result of increased financial dominance over corporate governance. The American case is contrasted with the more successful case of Japan, where these changes to corporate governance did not occur. Insulated from shareholder pressure and financial turbulence, Japanese photovoltaics manufacturers continued to expand investment throughout the 1980s when their American rivals were cutting back. The study is informed by Joseph Schumpeter's theory of creative destruction and Hyman Minsky's theory of financialization, along with economic sociology. By highlighting the tenuous and conflicting relation between finance and production that shaped the early history of the photovoltaics industry, the article raises doubts about the prevailing approach to mitigate climate change through carbon pricing. Given the uncertainty of innovation and the ease of speculation, it will do little to spur low-carbon technology development without financial structures supporting patient capital.

© 2017 Tech Xplore