The Libra Assocation launched this week in Geneva

Facebook's controversial plans for a new digital currency will again come under scrutiny of finance officials from Group of Seven economies Thursday, who worry it undermines their hold over the global financial system.

Libra, which would be backed by reserve assets unlike cryptocurrencies like Bitcoin, faces a steady drumbeat of stern warnings from central bankers and financial regulators, who have promised close oversight and tough regulation.

European Central Bank board member Benoit Coeure is due to present a report on digital currencies to the G7 finance ministers, who are gathering on the margins of the annual meetings of the International Monetary Fund and World Bank.

Earlier this year, G7 ministers tasked Coeure with studying the risks that digital currencies like Libra pose for states and central banks, which are currently the only institutions with the power to issue fiat money.

France, which currently holds the G7's rotating presidency, expects to issue a statement following the meeting, according to a person with knowledge of the matter.

But the ministers already called for tough regulations, warning of the "serious regulatory and systemic concerns" around digital currencies.

Since the July meeting in France, warnings from officials have only grown louder, with French Economy Minister Bruno Le Maire announcing a month ago he would block Libra in Europe.

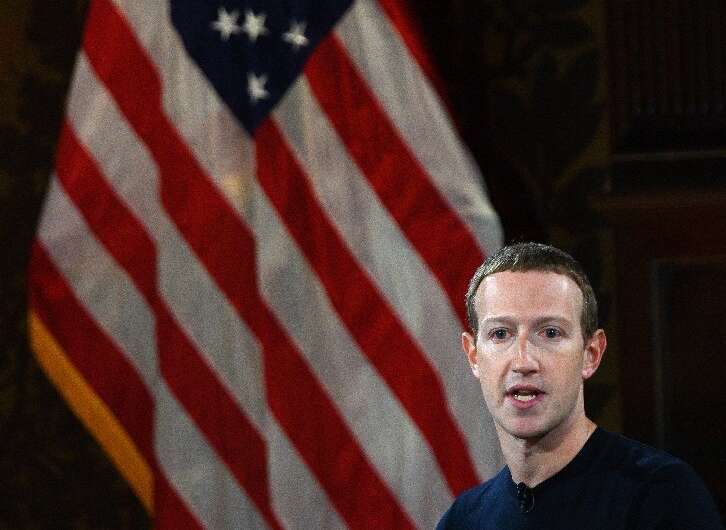

Facebook founder Mark Zuckerberg was in Washington as G7 ministers prepare to release a report about the social network's plan to release a digital currency

Libra members drop out

If it enters circulation, Libra would offer an alternative to traditional bank financial transfers, a disruptive change that has aroused resistance and skepticism.

Mark Zuckerberg, Facebook's co-founder and chief executive, was in Washington as well Thursday, and is due to testify before the US Congress next week on the social media network's impact on financial services.

Le Maire stepped up his opposition in a Financial Times opinion piece Thursday that called Facebook's digital currency a threat to states' sovereignty.

Lael Brainard, an influential member of the US Federal Reserve board, said Facebook's proposed currency presented a host of risks and regulatory challenges for preventing money-laundering and assuring financial stability, and could be a challenge to the traditional role played by banks

"There are likely to be financial stability risks for a stablecoin network with global reach," she said in a speech Wednesday. "If not managed effectively, liquidity, credit, market, or operational risks—alone or in combination—could trigger a loss of confidence and a classic run."

China, which is not a G7 member and decided two years ago to block cryptocurrency transactions, has recently sped up plans to introduce its own digital money.

Libra also has faced challenges from within after major financial and commercial players in recent weeks have backed out of the project, including Visa, Mastercard, eBay, Stripe, PayPal and the online travel firm Bookings Holdings.

The Libra Association, which will oversee Facebook's proposed currency, was officially launched Monday in Geneva.

The 21 founding members include the online payments company PayU, the telecoms firms Vodafone and Iliad, as well as tech outfits Uber, Spotify and Farfetch, blockchain operations such as Anchorage, Xapo and Coinbase and the venture capital firms Andreessen Horowitz, Ribbit Capital and non-profits Kiva and Mercy Corps.

© 2019 AFP