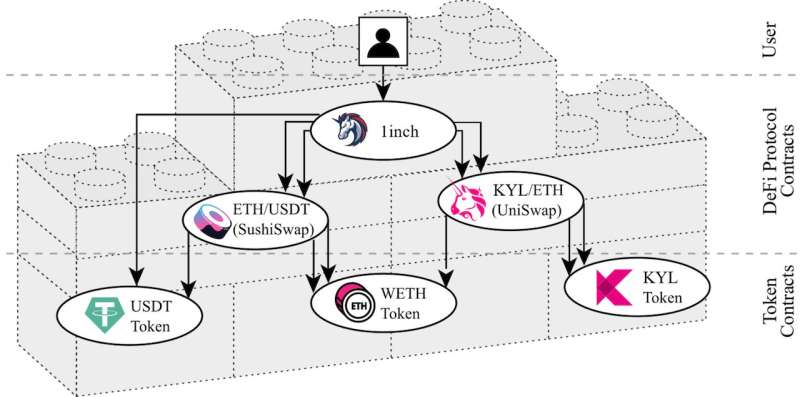

Illustration shows how the proposed algorithm separates the financial services (DeFi protocols) for swapping the USDT to the KYL cryptoasset. The end-user interacts with the 1inch services, but the service uses internally with two Decentralized Exchanges (DEXs) and the wETH token, as an intermediary cryptoasset. Credit: Complexity Science Hub Vienna and TU Berlin

It has been an extremely turbulent year for the crypto world. In particular, the collapses of the stablecoin Terra at the beginning of the year and the one of the crypto exchange FTX two weeks ago left many investors stunned. New research from CSH Vienna shows how hypothetical cryptoasset failures could affect other financial services on Ethereum.

"After the collapse of the algorithmic stablecoin TerraUSD and its sister coin Luna earlier this year, other stablecoins have become the focus of attention. It is important to understand them, because they are an interface to the traditional financial sector and might propagate failures," explains Bernhard Haslhofer, head of the Cryptofinance research group at the Complexity Science Hub Vienna (CSH Vienna).

Stablecoins are cryptocurrencies whose value is supposed to be bound to some other asset, like the US dollar. However, a series of coordinated speculative trades broke these ties, and TerraUSD as well as Luna were suddenly worthless.

Stablecoins are an essential building block

While analyzing several Decentralized Finance (DeFi) services, CSH researchers found that many rely on stablecoins like Tether. "Individual financial service providers use Tether in more than 14% of their executions, leading to a comparably high dependency on this particular asset," says CSH researcher Stefan Kitzler. If Tether loses it's value for whatever reason, many other DeFi services would be affected.

Besides this incident, 2022 experienced hacks, exploits, or collapses of crypto-related projects almost every month. With a record of around $760 million stolen in October, it's not called Hacktober for no reason. "While the Bitcoin blockchain only enables the transfer of bitcoins between users, new blockchains such as Ethereum also allow for more complex financial operations such as lending or trading multiple cryptoassets that reflect assets outside the blockchain," Kitzler says.

New algorithm unravels financial services on the Ethereum blockchain

For end users, the inner mechanisms of these financial services remain hidden and they are usually not aware of which other services are being used in the background.

Fortunately, CSH researchers have now unraveled the structure and building blocks of financial services on the Ethereum blockchain. They developed an algorithm that dissects these financial transactions and shows how the services are interwoven.

What they found were highly intertwined structures. "We are dealing here with complex financial products that are very difficult to understand and involve risks that are not yet fully understood," says Kitzler.

Strong dependencies and unknown risks

The internal structure of these financial services can be imagined as a construct made up of several building blocks. "The upper building blocks depend on the lower ones. Because of this structure and the repeated use of certain blocks, the entire system is heavily dependent on very specific basic service blocks," Kitzler says. If such a building block breaks away, it will affect other blocks building on it.

Decentralized Finance (DeFi) services—this entire complex of financial services related to crypto-assets—typically offer easy access through their websites, like e-banking offered by traditional banks. This low barrier to entry, or even gamification, has led to the popularity of DeFi and billions of dollars invested in the market.

Recent events in the crypto space and these research findings clearly show that cryptoassets are risky investments and that failures might affect financial services in the crypto and possibly also in the traditional financial world. "The first thing we need to do is create transparency and awareness. Users need to understand what exactly is behind a certain crypto financial service and what risks are involved," says Kitzler.

"In light of recent events, it is clear that understanding potential systemic risks associated with cryptoassets and decentralized financial services must also become a top priority for regulators and policymakers," concludes Bernhard Haslhofer.

The work is published in the journal ACM Transactions on the Web.

More information: Stefan Kitzler et al, Disentangling Decentralized Finance (DeFi) Compositions, ACM Transactions on the Web (2022). DOI: 10.1145/3532857

Provided by Complexity Science Hub Vienna