A worker helps set up a booth before CES International, Saturday, Jan. 4, 2020, in Las Vegas. (AP Photo/John Locher)

What will watching TV be like in the 2020s? Amid new gadgets and glitz, the CES tech show in Las Vegas aims to offer some answers, many of which boil down to more streaming and more efforts to glue you to your phone.

The show's keynote addresses, once dominated by computer and chip makers, will this year feature executives from TV networks NBC and CBS and upstart video services like mobile-focused Quibi and free streamer Tubi. Topic one will be the streaming wars—not to mention mounting costs for consumers who want access to everything—as giants NBC Universal and WarnerMedia prepare to join the clash with Netflix later this year.

Some companies also promise a big new push into "bite-sized" video designed to draw mobile viewers from YouTube, despite the fact that a similar effort several years ago foundered.

CES, formerly known as the Consumer Electronics Show, starts Sunday in Las Vegas with two days of media previews. The show floor opens Tuesday through Friday. More than 170,000 people are expected, with 4,500 companies exhibiting, according to its organizers. The show takes place across a sprawling set of hotels and convention centers equivalent to more than 50 football fields.

Beyond streaming, expect to see artificial intelligence-infused home appliances, security cameras and cars, new gadgets that show what faster 5G cellular service can offer and, as always, the newest in robots and souped-up TVs. Speakers this week include Ivanka Trump, the president's daughter and senior adviser, and Hyunsuk Kim, Samsung's head of consumer electronics.

A worker helps set up the Google booth before CES International, Saturday, Jan. 4, 2020, in Las Vegas. (AP Photo/John Locher)

As technology increasingly infuses our lives, more traditional companies are showing up for the Las Vegas event. There's a new travel section, for example, with Delta Air Lines its largest exhibitor.

CES has hosted previous attempts to set out a road map for TV. At the 2015 show, satellite TV company Dish announced a cheaper, cable-like package of TV channels delivered over the internet and intended for cord-cutters . Offerings from Sony, DirecTV, Google, Hulu and others soon joined Dish's Sling TV.

But five years later, these online alternatives have been struggling, raising prices and in the case of Sony's PlayStation Vue, shutting down altogether.

So it's on to Plan B: Owners of television channels and producers of their shows are selling Netflix-like subscription services directly to consumers. Disney Plus launched in November, while WarnerMedia's HBO Max and NBCUniversal's Peacock are coming in a few months. If people would rather pay for subscriptions such as Netflix instead of traditional television channels through cable packages, Disney and other media companies figure they might as well try to get some of that money directly.

Workers help set up the Google booth before CES International, Saturday, Jan. 4, 2020, in Las Vegas. (AP Photo/John Locher)

But they face competition from tech companies also seeking to replicate and encroach on Netflix's success. Apple launched its own streaming service in November, while Quibi promises phone-friendly viewing, with former Disney studios chief Jeffrey Katzenberg behind the effort.

"Bets have been made and billions of dollars have been spent on content," said Peter Csathy , founder and chairman of digital media consulting firm CreaTV Media. "Those numbers will only go up as all these Goliaths and then the new guys coming on board are all looking for ways to break out."

Katzenberg and Quibi CEO Meg Whitman, the former CEO of Hewlett Packard Enterprise, will use a Wednesday keynote to provide details on Quibi, which is investing $1 billion on new shows with backing from all the major movie studios.

A person walks by a booth display before CES International, Saturday, Jan. 4, 2020, in Las Vegas. (AP Photo/John Locher)

Short for "quick bites," the mobile-first service is designed to be watched for a just a few minutes at a time. Video programs are broken into 10 minute "chapters"—about the same length as broadcast TV segments between commercial breaks—intended for on-the-go viewers with limited attention spans .

"We want to take a phone, a device that was not actually designed to watch video on, and make it into a great watching device," Whitman said in an interview.

But previous short-video efforts have flopped. In 2018, Verizon pulled the plug on its Go90 service in 2018, roughly three years after it launched; it featured short-form original programs along with live sports and older TV shows. Several concurrent efforts have also shut down. Meanwhile, Netflix, Amazon and Hulu have all been experimenting with short-form offerings, many of them in comedy.

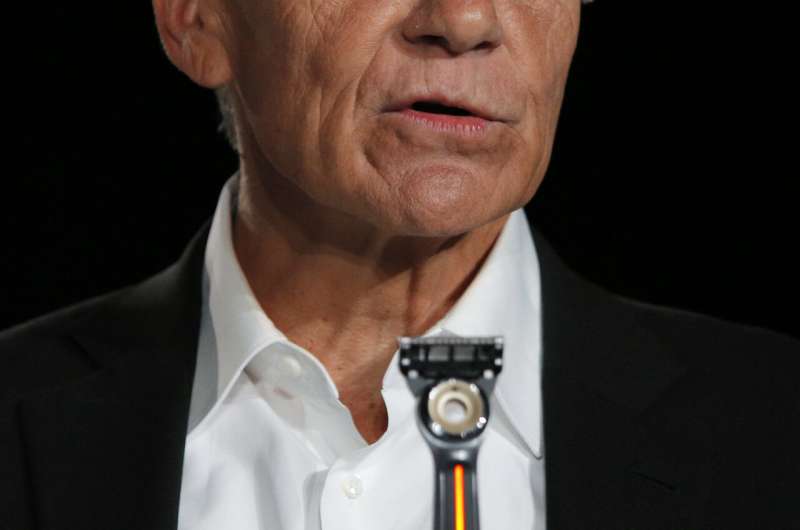

Procter & Gamble Chief Brand Officer Marc Pritchard shows off the Charmin Forever Roll and the Charmin RollBot during a Procter & Gamble news conference before CES International, Sunday, Jan. 5, 2020, in Las Vegas. (AP Photo/John Locher)

Quibi will also preview some of its 20 new shows, including "Chrissy's Court," a Judge Judy-style show from Chrissy Teigen. It is also debuting with movies and other content like news and weather. Quibi launches April 6 for $5 a month with ads and $8 without.

NBC executives won't offer more details on its upcoming Peacock service until Jan. 16. Instead, they will trot out "America's Got Talent" host Terry Crews, "This is Us" star Mandy Moore and other NBC luminaries at CES to talk more generally about the future of TV and entertainment.

"Audiences don't differentiate by screen anymore," said Linda Yaccarino, chairman of advertising and partnerships at NBCUniversal. "They want and expect an on-demand, always-on world."

As television companies experiment with making more shows available in more ways, they'll also accumulate data on viewing habits far beyond what they got with over-the-air and cable channels. That will help them target advertising to viewers' interests and make recommendations for other shows to keep viewers glued.

-

Procter & Gamble Chief Brand Officer Marc Pritchard shows off the Charmin Forever Roll and the Charmin RollBot during a Procter & Gamble news conference before CES International, Sunday, Jan. 5, 2020, in Las Vegas. (AP Photo/John Locher)

-

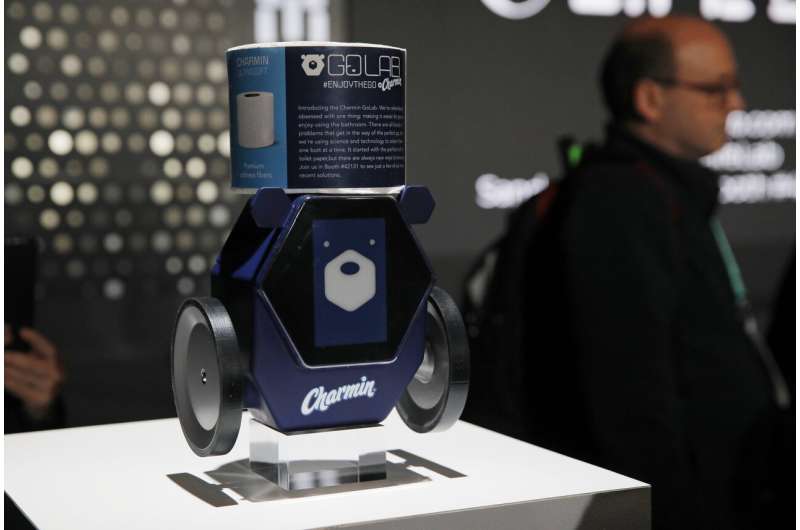

The Charmin RollBot is on display during a Procter & Gamble news conference before CES International, Sunday, Jan. 5, 2020, in Las Vegas. (AP Photo/John Locher)

-

The Opte, a beauty device for age spot removal and facial toning, is demonstrated during a Procter & Gamble news conference before CES International, Sunday, Jan. 5, 2020, in Las Vegas. (AP Photo/John Locher)

-

Procter & Gamble Chief Brand Officer Marc Pritchard shows holds up the Gillette Heated Razor during a Procter & Gamble news conference before CES International, Sunday, Jan. 5, 2020, in Las Vegas. (AP Photo/John Locher)

-

The Pampers Lumi connected diapers are on display during a Procter & Gamble news conference before CES International, Sunday, Jan. 5, 2020, in Las Vegas. (AP Photo/John Locher)

-

The Opte, a beauty device for age spot removal and facial toning, is demonstrated during a Procter & Gamble news conference before CES International, Sunday, Jan. 5, 2020, in Las Vegas. (AP Photo/John Locher)

-

The Charmin RollBot is on display during a Procter & Gamble news conference before CES International, Sunday, Jan. 5, 2020, in Las Vegas. (AP Photo/John Locher)

-

The Charmin RollBot is on display during a Procter & Gamble news conference before CES International, Sunday, Jan. 5, 2020, in Las Vegas. (AP Photo/John Locher)

-

Procter & Gamble Chief Brand Officer Marc Pritchard talks about the Oral B iO smart toothbrush during a Procter & Gamble news conference before CES International, Sunday, Jan. 5, 2020, in Las Vegas. (AP Photo/John Locher)

-

The Pampers Lumi connected diaper is on display during a Procter & Gamble news conference before CES International, Sunday, Jan. 5, 2020, in Las Vegas. (AP Photo/John Locher)

-

The Oral B iO smart toothbrush is on display during a Procter & Gamble news conference before CES International, Sunday, Jan. 5, 2020, in Las Vegas. (AP Photo/John Locher)

-

Fama Francisco, CEO of Procter & Gamble baby and feminine care, speaks about the Pampers Lumi connected diaper during a Procter & Gamble news conference before CES International, Sunday, Jan. 5, 2020, in Las Vegas. (AP Photo/John Locher)

-

The Gillette Heated Razor is on display during a Procter & Gamble news conference before CES International, Sunday, Jan. 5, 2020, in Las Vegas. (AP Photo/John Locher)

-

The Gillette Treo razor is on display during a Procter & Gamble news conference before CES International, Sunday, Jan. 5, 2020, in Las Vegas. (AP Photo/John Locher)

-

Fama Francisco, CEO of Procter & Gamble baby and feminine care, speaks about the Airia smart fragrance dispenser during a Procter & Gamble news conference before CES International, Sunday, Jan. 5, 2020, in Las Vegas. (AP Photo/John Locher)

Companies will also test different pricing models in 2020, as they try to figure out how and how much consumers will be willing to pay. Is there a limit to how many services consumers will pay for? Will they adapt to separate prices with and without ads? Or will they flock to free services like Tubi, even if they lack original movies and TV shows?

Kevin Westcott, who heads Deloitte's U.S. telecommunication, media and entertainment consulting business, notes that consumers are getting more choices and shows than ever, just as new technologies such as high-quality TV displays and faster 5G cellular networks come along.

The downside? "Too much choice and too much technological change" at once, he said, which could make viewers wary of new options, he said.

© 2020 The Associated Press. All rights reserved.