This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

peer-reviewed publication

trusted source

proofread

Securing competitiveness of energy-intensive industries through relocation: The pulling power of renewables

Countries with limited potential for renewables could save up to 20% of costs for green steel and up to 40% for green chemicals from green hydrogen if they relocated their energy-intensive production and would import from countries where renewable energy is cheaper, finds a new study by the Potsdam Institute for Climate Impact Research (PIK).

This 'renewables pull' would create strong incentives for businesses to invest in low-emission production facilities in these renewable-rich countries. Renewable-scarce countries could put all focus on down-stream production and refinement as the smart way to secure industrial competitiveness.

"Our new study shows that renewable-scarce countries like parts of the EU, Japan and South Korea could save between 18 to 38 percent in production costs," explains Philipp Verpoort, scientist at the Potsdam Institute for Climate Impact Research (PIK) and lead author of the study published in Nature Energy.

"They could do so by relocating their production of industrial basic materials like green steel and chemicals based on green hydrogen to countries where renewable energy is cheap."

The use of renewable electricity and green hydrogen is a key solution to cut greenhouse gas emissions when producing steel and chemicals. However, not all industrialized countries would be able to produce these in sufficient quantities and at competitive prices in the long term due to their geographical conditions.

"If these countries focus on producing green hydrogen domestically or importing it, this will be costly for both industry and society. It could even become a dead-end as it results in a lack of long-term competitiveness on global markets. Importing industrial intermediate goods such as iron sponge, ammonia, or methanol and focusing on downstream production and refinement could be a cheaper and more robust strategy for securing competitiveness," explains Verpoort.

Importing hydrogen via ship could hinder long-term competitiveness of hydrogen-based value chains

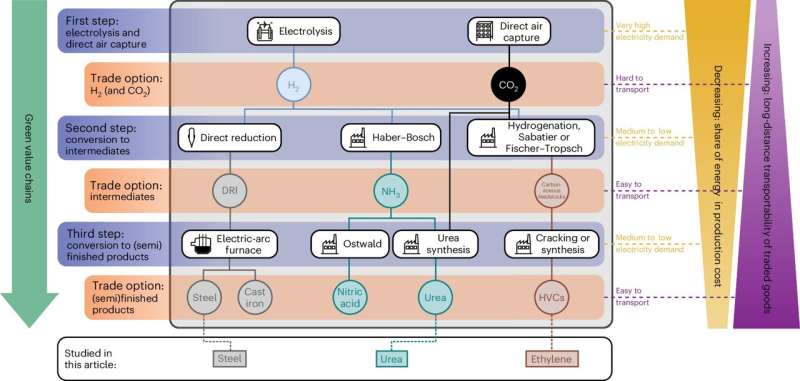

To arrive at these results, the scientists looked at the green value chains of three primary basic materials: steel, urea and ethylene. They argue that an electricity-price difference of 4ct/kWh between some existing renewable-scarce industrial production sites (e.g. Germany, Japan or South Korea) and favorable locations elsewhere on the globe (e.g. Australia, Chile, South Africa) can be expected in 2040.

The researchers then assessed the cost effectiveness of competing decarbonization strategies by comparing different trade options—import of industrial products, import of intermediate products, import of hydrogen, and no imports (i.e. full domestic production). Their research demonstrates that cost savings in case of relocation could be huge and that importing hydrogen does not seem to be a cost-effective strategy—especially when imports occur via ship.

The study also discusses other factors that will influence the investment decisions of companies, such as benefits of short and integrated value chains, reliability of supply chains, quality requirements, and public subsidies for low-emission production. However, according to the authors, those alone are unlikely to prevent a partial 'green relocation' of production, given the magnitude of cost savings derived in the study.

Green relocation: Transforming trade patterns can be a global win-win scenario

"We anticipate a global reconfiguration of trade and production in energy-intensive industry sectors. Production will likely shift towards countries abundant in renewable resources while moving away from regions facing constraints in this regard. This shift is often labeled as 'deindustrialization' by proponents of costly, permanent industrial policies aimed at protecting national production. However, this term is both inaccurate and misleading," explains Falko Ueckerdt, Senior Scientist at PIK and co-author of the study.

"It is only the first few steps of the long value chains of energy-intensive basic materials that will likely be relocated. This shift presents a potential win-win scenario for both importing and exporting countries. Developing countries with cheap access to renewables, for instance, stand to become exporters and reap the benefits of industrialization.

"At the same time, industrialized countries can focus on their economic strengths by specializing in those industrial activities that create the most economic value from scarce and expensive green energy, such as making green steel from sponge iron and processing it further."

More information: Impact of global heterogeneity of renewable energy supply on heavy industrial production and green value chains., Nature Energy (2024). DOI: 10.1038/s41560-024-01492-z