Research calls for better balance of taxes and levies on energy bills

The taxes and levies on energy prices have a major impact on energy use and the funds available to governments to promote reduced dependency on fossil fuels. A new study, published in Energy Policy, reveals significant imbalances in the way five European countries apportion fuel taxes, and indicates that environmental costs are seldom well-reflected in energy prices.

The research, led by Jan Rosenow at the Regulatory Assistance Project, compared the structure of energy taxes and levies across Europe, with particular focus on five countries: Belgium, Germany, Italy, Spain and the U.K.

The study explains methods for assessing existing taxes and levies in the context of the environmental and social costs of different heating sources, and also presents a method for calculating the effects of suggested tax and levy policy reforms.

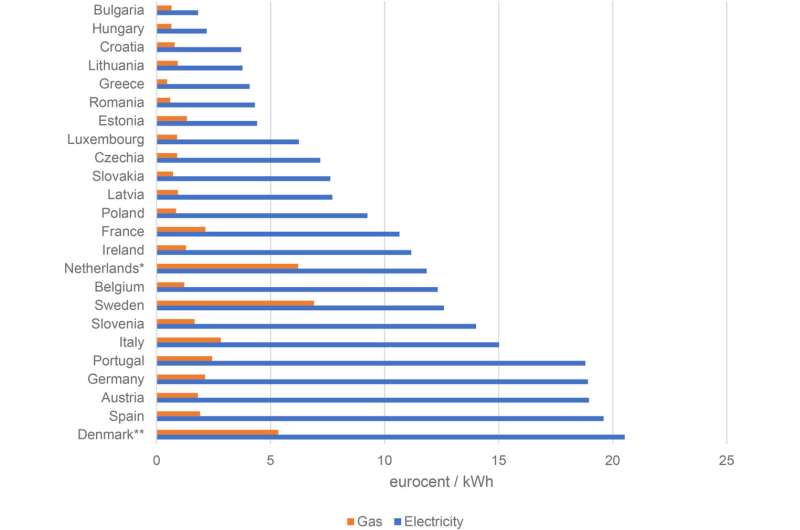

Applying these methods to current arrangements in the five countries reveals significant imbalances in how fuel taxes and levies are shared out. It also indicates that environmental costs are rarely well-reflected in energy prices, and that the costs of energy transition programs and related social policies are overwhelmingly borne by electricity consumers.

The authors offer four examples of reforms that would rebalance taxes and levies between electricity and heating fuels. These suggestions could drive the changes in energy sources that governments wish to encourage as part of plans to decarbonize energy supplies.

An optimum mix of reforms would see higher fossil fuel taxes and lower electricity taxes, reflecting the respective environmental costs, along with a redistribution of levy costs from electricity consumers to taxpayers.

The reforms would be in line with the basic principle of efficient taxation, allowing prices to reflect all costs related to production, including environmental costs. They would also more effectively allow money raised through general taxation to fund relevant social spending, including subsidies to encourage the desired transition to more environmentally friendly energy supply options.

More information: Jan Rosenow et al, Clean heating: Reforming taxes and levies on heating fuels in Europe, Energy Policy (2022). DOI: 10.1016/j.enpol.2022.113367