This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

peer-reviewed publication

trusted source

proofread

More predictable renewable energy could lower costs

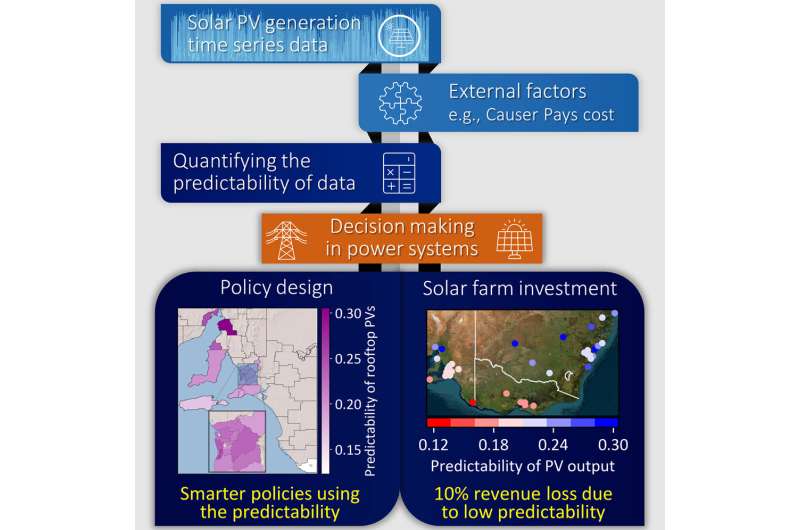

Lower electricity costs for consumers and more reliable clean energy could be some of the benefits of a new study by the University of Adelaide researchers who have examined how predictable solar or wind energy generation is and the impact of it on profits in the electricity market.

Ph.D. candidate Sahand Karimi-Arpanahi and Dr. Ali Pourmousavi Kani, Senior Lecturer from the University's School of Electrical and Mechanical Engineering, have looked at different ways of achieving more predictable renewable energy with the aim of saving millions of dollars in operating costs, prevent clean energy spillage, and deliver lower-cost electricity.

"One of the biggest challenges in the renewable energy sector is being able to reliably predict the amount of power generated," said Mr. Karimi-Arpanahi.

"Owners of solar and wind farms sell their energy to the market ahead of time before it is generated; however, there are sizable penalties if they don't produce what they promise, which can add up to millions of dollars annually."

"Peaks and troughs are the reality of this form of power generation, however using predictability of energy generation as part of the decision to locate a solar or wind farm means that we can minimize supply fluctuations and better plan for them."

The team's research, published in Patterns, analyzed six existing solar farms located in New South Wales, Australia and selected up to nine alternative sites, comparing the sites based on the current analysis parameters and when the predictability factor was also considered.

The data showed that the optimal location changed when the predictability of energy generation was considered and led to a significant increase in the potential revenue generated by the site.

Dr. Pourmousavi Kani said the findings of this paper will be significant for the energy industry in planning new solar and wind farms and public policy design.

"Researchers and practitioners in the energy sector have often overlooked this aspect, but hopefully our study will lead to change in the industry, better returns for investors, and lower prices for the customer," he said.

"The predictability of solar energy generation is the lowest in South Australia each year from August to October while it is highest in NSW during the same period."

"In the event of proper interconnection between the two states, the more predictable power from NSW could be used to manage the higher uncertainties in the SA power grid during that time."

The researchers' analysis of the fluctuations in energy output from solar farms may be applied to other applications in the energy industry.

"The average predictability of renewable generation in each state can also inform power system operators and market participants in determining the time frame for the annual maintenance of their assets, ensuring the availability of enough reserve requirements when renewable resources have lower predictability," said Dr. Pourmousavi Kani.

More information: Sahand Karimi-Arpanahi, Quantifying the predictability of renewable energy data for improving power systems decision-making, Patterns (2023). DOI: 10.1016/j.patter.2023.100708. www.cell.com/patterns/fulltext … 2666-3899(23)00045-4