This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

trusted source

written by researcher(s)

proofread

The move to a cashless society isn't just a possibility, it's well underway

When was the last time you used cash? For many Australians using cash or even swiping a card has become a rare event.

The move towards a cashless society started 50 years ago with the introduction of the Bankcard and was driven by technological advancements. But it really took off with the COVID pandemic when consumers and retailers were reluctant to handle potentially infected notes and coins.

The federal government last week underscored its recognition of this trend by unveiling reforms to regulate digital payment providers. Treasurer Jim Chalmers said, "As payments increasingly become digital, our payments system needs to remain fit for purpose so that it delivers for consumers and small businesses. We want to make sure the shift to digital payments occurs in a way that promotes greater competition, innovation and productivity across our entire economy."

From big cities to remote rural corners the shift towards digital payments is evident. This raises the question, is a cashless society inevitable?

The phenomenal growth of the digital payments

The convenience of digital transactions has become irresistible for consumers and businesses and has led to the sector eclipsing traditional payment methods.

The relentless march of technology has produced myriad innovative platforms from mobile wallets to buy-now-pay-later (BNPL) schemes, each vying for a piece of this burgeoning market.

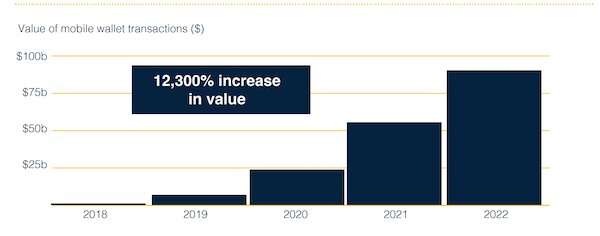

A recent report by the Australian Banking Association paints a vivid picture of the digital payment industry's explosive expansion.

The use of digital wallet payments on smartphones and watches has soared from $746 million in 2018 to over $93 billion in 2022. Cash only accounts for 13% of consumer payments in Australia as of the end of 2022, a stark contrast to 70% in 2007.

Digital wallets are popular with most age groups. Young Australians aged between 18 and 29 are leading the pack, with two thirds using digital wallets to pay for goods and services.

About 40% of Australians are comfortable leaving home without their actual wallets or even credit or debit cards, as long as they have their mobile devices with digital wallets.

The astonishing speed at which Australians have embraced digital payments places the country among the top users of cashless payments globally, surpassing the United States and European countries.

Digital wallets are not the only players in this space. The use of BNPL products is also growing rapidly in Australia, which was where many of the large-scale products in this category started.

The Australian Securities and Investment Commission (ASIC) reports the total value of all BNPL transactions increased by 79% in the 2018–19 financial year. This continues into 2022 with an annual growth beyond 30% according to the Reserve Bank of Australia (RBA).

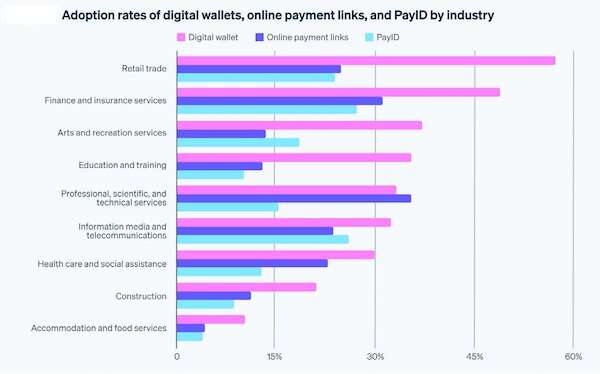

PayID and PayPal payments are also claiming their shares in this space.

Are government regulations necessary?

The government's planned regulation of the system, contained in amendments to the Reforms to the Payment Systems (Regulation) Act 1998, is a big step towards establishing a secure and trustworthy cashless society in Australia.

It will subject BNPL and digital wallet service providers like Apple Pay and Google Pay to the same oversight by the RBA as traditional credit and debit cards.

The regulations will require providers meet clear standards for security measures, data protection and dispute resolution to give Australians confidence their funds and personal information are safeguarded.

With increasing concern over cyber attacks, the regulations will help reduce the risk of fraudulent activities and money laundering and help identify suspicious transactions, maintaining the integrity of the financial system.

Also, regulation will promote fair competition and market stability by leveling the playing field and by preventing monopolies.

While banks support the forthcoming regulation, new market players are less positive. For example, Apple Pay says it is merely providing technical architecture rather than payment services.

The current regulatory debate is not new. When credit cards made their debut in Australia in the early 1970s, there were hardly any safeguards for consumers. This led to card users being hit with high interest rates on money owed, sneaky fees and aggressive marketing tactics.

Consequently, regulations were introduced to hold card providers to a standard of responsible behavior. Today, they must openly disclose interest rates, fees and charges, and follow stringent guidelines in advertising their products and services.

Regulating digital wallet providers strikes a crucial balance between innovation and accountability, ensuring life-changing technology continues to serve the public interest.

The shift towards a cashless society in Australia isn't just a possibility, it's already well underway.

The blend of technological advancements, changing consumer preferences and regulatory adaptations has set the stage for this transformation. The new regulations will help Australians navigate this transition more confidently.

This article is republished from The Conversation under a Creative Commons license. Read the original article.![]()