November 10, 2023 dialog

This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

trusted source

written by researcher(s)

proofread

Blockchain: A game changer for the insurance industry and people's well-being

Blockchain, a disruptive technology of our time, holds the potential to change our lives for the better. The insurance sector is a prime illustration.

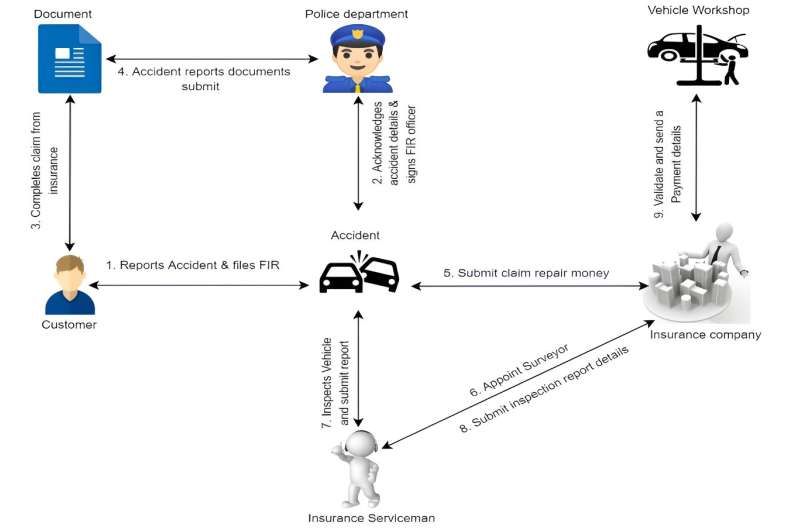

Ever wondered how vehicle insurance claims could become a seamless, user-controlled process? Traditionally, managing insurance claims has been a complex process (Figure 1). It is akin to a complex puzzle with many pieces. It involves numerous parties and relies heavily on human communication, making it susceptible to delays and errors. The central systems currently in place struggle with trust, transparency, and accessibility issues, among others, which inevitably lead to problems for insurance providers and policyholders alike.

Blockchain technology provides a promising solution to these challenges. At its core, blockchain is a highly secure and transparent digital ledger that records transactions between parties. It operates in a decentralized, peer-to-peer network, ensuring data integrity through consensus. This technology has the potential to revolutionize the insurance industry.

The power of smart contracts

As the insurance sector undergoes a digital transformation, blockchain plays a pivotal role in making insurance processes, from health and business to car insurance, more efficient and secure.

Smart contracts are one of the jewels in blockchain's crown. These are self-executing agreements with terms and conditions encoded directly into the digital fabric. They eliminate any room for ambiguity and fraud, offering a clear path to understanding the legal intricacies.

The result is fewer gray areas, reduced dependency on trust, and minimal financial risks within agreements. Implementing blockchain and smart contracts can pave the way for more transparent, efficient, and fraud-resistant insurance policies.

Vehicle Accident Register Blockchain (VARB)

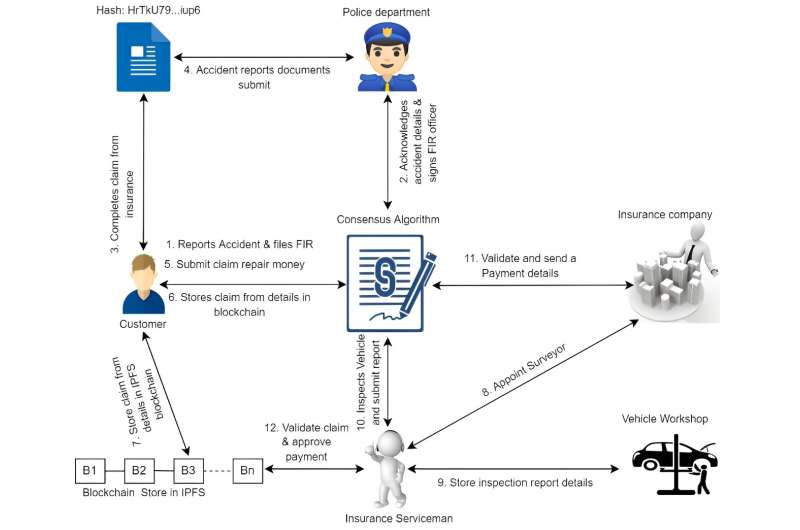

In a recent paper published in Expert Systems with Applications, we introduced a Vehicle Accident Register Blockchain (VARB), an innovative solution powered by blockchain technology. Participants in the proposed blockchain network include individual drivers/owners, regional legal authorities, insurance companies, service technicians, auto manufacturing companies, and the government regional transport office (Figure 2).

People facing accidents may no longer be overwhelmed by the process. With VARB, it's all about making life easier and becoming hassle-free. In this sense, VARB not only streamlines accident reporting and claims processing but also empowers users like never before.

By leveraging Hyperledger Fabric, this system secures crucial information about vehicles, their owners, and insurance policies. It accelerates claims processing and grants users greater control over transactions, inspections, and policy management. An intelligent consensus algorithm even spots and prevents invalid claims, reinforcing trust and security within the insurance domain.

Policymaking for blockchain in insurance

As the insurance landscape evolves at a rapid pace, blockchain offers a myriad of advantages. It simplifies reinsurance claims through smart contracts, makes personal accident insurance more user-friendly, enhances record-keeping, and digitizes customer records.

But to fully realize the potential of blockchain in the insurance sector and enhance people's well-being, effective policymaking is poised to play a critical role. Policies could be designed to encourage insurance companies to adopt blockchain solutions. Some of the strategies that policymakers may consider are:

- Enact policies that establish clear and favorable standards for integrating blockchain within the insurance industry. Single record maintenance and interoperability should be at the forefront of these policies.

- Develop policies that are built based on the cooperation of various stakeholders, such as legal authorities, customers, insurance providers, technology providers, and more. The result would be the creation of industry-wide standards and best practices for blockchain adoption. Additionally, it would encourage "coopetition" among insurance providers—the cooperative competition among these parties to create policies that ensure a smoother, more efficient insurance ecosystem.

- Establish sandbox environments where insurance companies can experiment with blockchain solutions in a controlled setting. This will enable them to test and refine their implementations without immediate regulatory constraints.

Overall, blockchain is more than just a buzzword; it's a transformative technology that can significantly enhance the well-being of individuals through improved insurance processes. By embracing blockchain's robust security and transparency, we're on the cusp of a more efficient, trustworthy, and fraud-immune insurance industry.

The adoption of blockchain-based insurance frameworks will undoubtedly lead to faster and fairer claims settlements, higher customer satisfaction and well-being, improved competitiveness, and cost savings resulting from enhanced efficiency and reduced fraudulence.

As we continue to innovate and adopt blockchain solutions, we move closer to a world where individuals can trust in insurance providers and policymakers more than ever before.

This story is part of Science X Dialog, where researchers can report findings from their published research articles. Visit this page for information about ScienceX Dialog and how to participate.

More information: Amrendra Singh Yadav et al, Blockchain-based secure privacy-preserving vehicle accident and insurance registration, Expert Systems with Applications (2023). DOI: 10.1016/j.eswa.2023.120651

Vincent Charles, PhD, PDRF, FRSS, FBCS, FHEA, MIScT, CMBE, is a Reader at Queen's Business School, Queen's University Belfast, and he holds multiple visiting professorship positions across the Globe. His area of expertise lies in the fields of Artificial Intelligence and Management Science, with a particular focus on boosting business productivity, fostering regional competitiveness, and enhancing societal welfare, and a well-rounded commitment to driving positive multi-dimensional impact. He has proven academic experience in the HE sector, with more than a decade of full professorship, and supports companies to enhance productivity via Predictive, Prescriptive, & Cognitive Analytics.