This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

trusted source

proofread

Though small in volume, gallium and germanium hold big potential for the global critical minerals market

Australia exports about 1 billion metric tons of iron ore each year and 300 metric tons of gold. Yet, beyond these well-known commodities lies a suite of lesser-known minerals, which are critical for the world's advancement.

Critical minerals are designated critical for their essential role in modern technologies. They are identified as critical based on a number of factors including supply chain security, economic benefits and strategic importance.

Australia already packs a punch in global critical mineral supply, producing 14 of the 31 minerals listed in Australia's Critical Minerals List. However, as the world's reliance on technology increases, and countries transition to renewable energy, there is an opportunity for Australia to grow its stake further.

The hidden gems: Gallium and germanium

Among Australia's unsung critical minerals are gallium and germanium. Like many critical minerals, they are not typically mined directly but are by-products of the processing of other minerals.

Both minerals hold significant growth potential for Australia, despite the country's current limited production.

Despite gallium being as abundant on earth as copper, it never occurs at high enough concentrations to mine. It occurs in small but appreciable quantities in bauxite which is the main ore source of alumina.

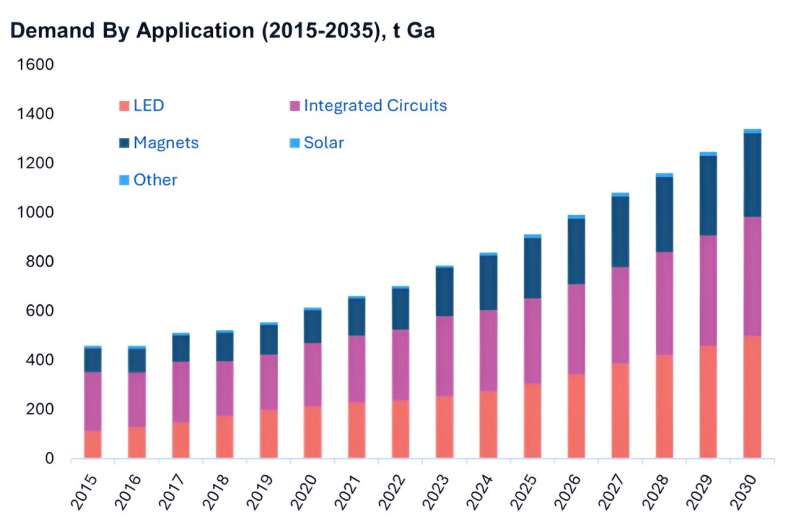

Global demand for gallium is only about 708 metric tons, so even small amounts are valuable.

Gallium is crucial for producing high-speed semiconductor chips and LEDs. It is also used to create solar photovoltaic (PV) cells and electronic devices that operate at high frequencies and temperatures, making it ideal for military and satellite communications.

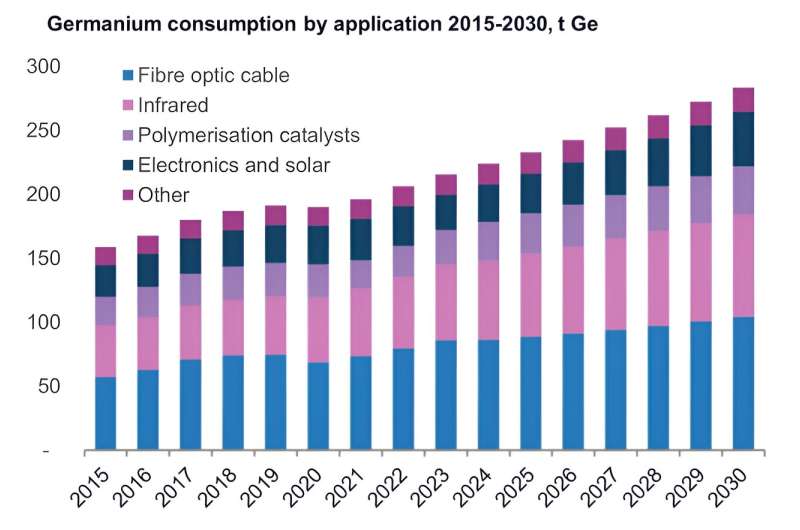

Germanium is a by-product of lead and zinc mining. This mineral plays a pivotal role in renewable technologies, particularly in solar cells and fiber optics, enhancing their efficiency and performance.

The global production of germanium is currently around 220 metric tons annually.

Unlocking Australia's critical mineral potential

Dr. Chris Vernon is our Australian Critical Minerals R&D Hub Lead. He said Australia had most of the critical minerals on any country's list so there was huge potential to grow.

"Gallium and germanium have recently gained attention because China is the main producer of each and the Chinese government has indicated that it will control export for strategic reasons. However, there are many other critical mineral markets Australia could have a role in," Chris said.

"Large amounts of potential byproduct is either left in the ground, goes to tailings, or is exported as a contaminant in the primary product because they don't usually cooperate, or separate easily, so you need process technology, and equipment.

"The cost of separating can be significant, and there's a lot of competition on price, so the decision to separate out some of these materials is often made on strategic grounds, rather than on economics."

The need for strategic mineral management

As part of the Australian Critical Minerals Research and Development Hub launched late last year, a project is underway with Geoscience Australia and ANSTO. It sets out to estimate the resource potential of critical minerals like gallium, germanium and indium in Australian zinc deposits.

The project aims to evaluate the techno-economic opportunities for Australia to produce these minerals from existing operations and explore the technical recovery of gallium from existing bauxite refineries.

The goal is to make the extraction process economically viable while meeting the growing demand for these critical minerals.

One significant challenge in such small critical minerals markets is the risk of oversupply. Processing too much of a particular mineral can flood the market, driving down prices and making the extraction process economically unviable. This delicate balance requires careful management to ensure a steady supply without overwhelming the market.

Jason Needham is Principal Consultant at global mineral economics firm CRU International. He said supply and demand shocks were usually the cause of price volatility in the critical minerals market.

"Over-supply will generally cause a price decrease, whereas higher demand will often result in price increases," Jason said.

"Small-volume markets, especially with niche critical minerals, are particularly sensitive. New mines or downstream plants coming online can drive a rapid increase in supply or even over-supply, resulting in a price drop. Often, market prices can also be affected by sentiment."

"A good recent example of this is the nickel market, which saw a moderate price increase largely brought about by the civil unrest in New Caledonia, despite the jurisdiction only producing around five percent of global supply," Jason said.

Developing strategies around Australia's critical minerals is crucial, particularly for those produced in smaller quantities like our quiet achievers, germanium and gallium.

Without strategic planning, these valuable resources might lose their value, making them uneconomical to extract.

Australia's growing role in critical mineral processing

"I expect Australia's role in the critical mineral supply chain will mostly remain in the mining of raw materials. However, with the introduction of Government incentives we will increasingly see Australia adding value through downstream mineral processing and refining," Jason said.

"A good example of this is lithium. In 2023, Australia produced 37% of global lithium raw materials in the form of mineral spodumene concentrates. However, Australia currently supplies only 5% of global lithium hydroxide. By 2028, CRU expects the country's market share will increase to 12%, representing a five-fold increase in refining capacity."

Extracting critical minerals was generally a challenging process, Chris said. Yet, processing them and turning them into engineered or functional materials would provide a massive uplift in value.

"An analogy is selling the wool, versus selling the yarn, versus selling the cloth, versus selling the suit," Chris said.

"The wool might be worth something and you don't need much processing to harvest it, but how much more is it worth if we take another step? These are some of the issues we have to consider. How far along the value chain does it make sense to go?"

Australia's potential in the critical minerals market is immense. Particularly now, with lesser-known minerals like gallium and germanium playing pivotal roles in modern technology and renewable energy.

By strategically developing these resources, enhancing processing technologies, and moving further up the value chain, Australia can significantly bolster its economic resilience and global market position.

Leveraging these quiet achievers not only secures a stable supply for high-tech industries, but also ensures Australia's sustainable and economically viable future in the critical minerals landscape.