This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

trusted source

proofread

Assessing the solvency of virtual asset service providers: Are current standards sufficient?

The collapse of FTX clearly highlights the importance of being able to evaluate the solvency of cryptocurrency exchanges. Currently, this is only possible to a limited extent. That's why researchers from the Complexity Science Hub (CSH), in collaboration with the Financial Market Authority (FMA) and the Austrian National Bank (OeNB), are now proposing a new approach.

Recently, a New York jury found Sam Bankman-Fried, the founder of the cryptocurrency exchange FTX, guilty of money laundering and fraud, among other charges. FTX was one of the largest trading platforms for crypto-assets and was valued at $32 billion before unexpectedly filing for insolvency in November 2022.

The working paper "Assessing the Solvency of Virtual Asset Service Providers: Are Current Standards Sufficient?" has been published on the OeNB website and is available for download.

Among other things, Bankman-Fried is alleged to have diverted around $14 billion of FTX customer funds to Alameda Research, an investment fund he also founded.

Automated auditing procedures

"Events like the FTX insolvency demonstrate the need for new solvency assessment methods for cryptocurrency exchanges," says Bernhard Haslhofer of the Complexity Science Hub.

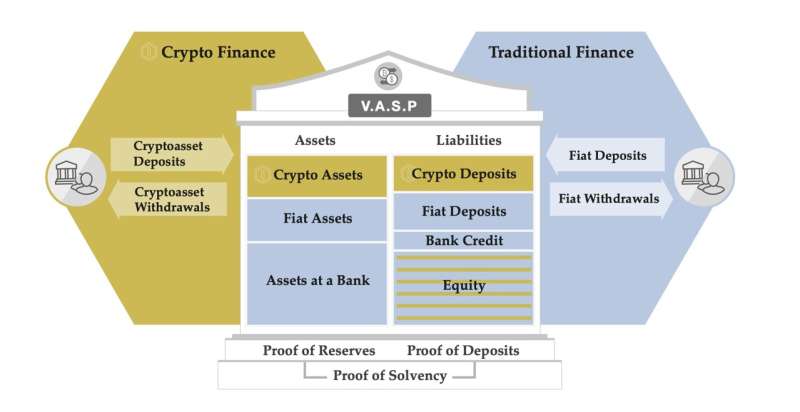

While traditional financial institutions adhere to established solvency assessment procedures, the evaluation of solvency among cryptoasset sector providers, known as Virtual Asset Service Providers (VASPs), is conducted on an ad-hoc basis and lacks a systematic approach. This is partly because assets are held in pseudonymous wallets on different blockchains and are not or only partially disclosed in available reports, such as balance sheets.

"However, transactions that occur on blockchains like Bitcoin and Ethereum are publicly viewable, opening up potential new opportunities for improving and automating current solvency analysis and evaluation procedures," says Haslhofer.

Two key measures

Firstly, the researchers suggest that VASPs should disclose their crypto asset wallet addresses and provide additional metadata describing the use of these wallets. In this way, independent auditors could assess whether a VASP has access to the funds associated with its on-chain wallets.

Secondly, VASPs should separate their balance reports into crypto and fiat assets and report them at appropriate intervals, according to the study.

Inconsistent data

"We examined a total of 24 VASPs registered with the Financial Market Authority in Austria," explains Pietro Saggese from the Complexity Science Hub. The researchers compared three data sources: the VASP's known crypto asset wallets, balance data from the trade register, and information from regulatory authorities.

"When comparing the known crypto asset holdings with the balance data, we found that they were only partially consistent," explains Haslhofer.

Three causes

The researchers attribute this inconsistency to three main factors. Firstly, not all VASPs separate their balance sheets for crypto and fiat assets, making it impossible to assess the proportion of assets from traditional currencies and crypto assets. Secondly, VASPs manage their crypto asset transactions in different ways. Thirdly, the crypto asset holdings of VASPs are currently not easily visible to third parties.

"FTX has clearly shown that crypto companies can slide into insolvency, potentially resulting in substantial losses for customers," says Haslhofer. "We hope that this study will help improve the analysis and evaluation of VASP solvency in the future. From a global perspective, we are undoubtedly at the forefront of this issue."

More information: Assessing the Solvency of Virtual Asset Service Providers: Are Current Standards Sufficient? www.oenb.at/dam/jcr:91ee2032-1 … 38a68f3cd/wp-248.pdf