This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

trusted source

proofread

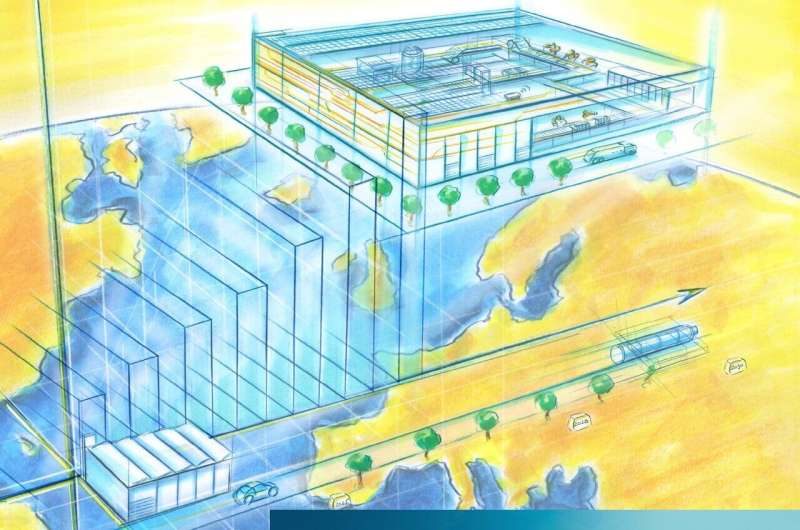

Industrialization perspectives for the lithium-ion industry

A new Fraunhofer ISI Lithium-Ion battery roadmap focuses on the scaling activities of the battery industry until 2030 and considers the technological options, approaches and solutions in the areas of materials, cells, production, systems and recycling. The study examines three trends in particular: The production of performance-optimized, low-cost and sustainable batteries.

The market for lithium-ion batteries continues to expand globally: In 2023, sales could exceed the 1 TWh mark for the first time. By 2030, demand is expected to more than triple to over 3 TWh which has many implications for the industry, but also for technology development and the requirements for batteries. For example, recent regulatory requirements mandate battery sustainability. The mass use of LIBs in electric vehicles has pushed the issue of battery price to the fore and more technical factors such as energy density and range into the background.

In this context, a new roadmap by Fraunhofer ISI focuses on "Industrialization Perspectives Toward 2030" and its analyses are based in particular on industry roadmaps and other announcements concerning the production or use of specific technologies. The roadmap was realized within the BEMA II project.

High-energy batteries and fast charging

Study findings for the first trend towards performance-optimized batteries show that over the next few years, there are ambitious development goals to significantly increase the parameters of energy density and fast-charging capability in particular.

For some flagship vehicles, charging rates will be accelerated to 4C and thus into the range of 10 to 20 minutes. To achieve these goals, the industry is turning to high-nickel cathodes, silicon anodes and new cell and pack designs that change space requirements, thermal coupling and safety characteristics. At the system level, for example, 800 V technology offers a new way to improve battery performance.

Objective: Cost reduction

A second major and maybe even more important trend is the reduction of battery costs. The roadmap shows that the cost target at the battery pack level is still well below 100 EUR/kWh which could mean a reduction of 30% to 50% compared to today's costs.

The industry aims to achieve this by using both cobalt- and nickel-free materials, standardizing cells and integrating them directly into the battery pack. New manufacturing processes could also contribute to reducing costs, both by leveraging energy and equipment costs and by standardizing the factory itself. Low battery cost could also be achieved by localizing factories to more advantageous production sites.

Toward sustainable batteries

The third trend, the production of sustainable batteries, is gaining momentum trough the EU Battery Directive, but also by an increasing number of car manufacturers. Specifically, sustainability can affect many factors, from raw material extraction to production and use scenarios. In the coming years, industrial developments are likely to focus on cell technologies and production technologies, some of which even combine sustainability, e.g., a low CO2 footprint with low cost.

These include iron- and manganese-based cathodes, water-based or dry electrode processing, and using recycling to recover materials at the end of the battery's life. The location of production also plays an important role in sustainability, influenced by factors such as the available energy mix and the distance to upstream and downstream production sites.

Batteries with clear profiles and use cases

The three key trends presented in the study can be contradictory: high performance is sometimes expensive and the high priority of a low environmental footprint may limit the use of some technologies, for example. As a result, the industry needs to diversify and produce batteries with clear profiles and use cases.

Cell manufacturers, automotive OEMs, start-ups and their joint ventures intend to build more than 10 TWh of annual cell production capacity by 2028. If likelihood of implementation and typical delays are taken into account, up to 5 TWh seem to be more realistic. Concerning the production of anode and cathode active materials, announcements of around 3 TWh were made for 2028, which is closer to the projected battery demand of the application markets of 2 to 3.5 TWh.

How battery recycling capacity will develop is still unclear. All the announcements made in recent years therefore show an asymmetrical picture along the LIB value chain, where the focus has long been on cell production. The industry has yet to catch up in the area of materials and components.

Europe on the way to self-sufficiency?

Dr. Christoph Neef, Scientific Coordinator of the Study, sees Europe on a good way to become an important player in global battery cell production: "In Europe, there are plans to build cell production capacities of 1.7 TWh due to increased electric vehicle production. Around 1 TWh seems to be realistic after adjustments for the likelihood of implementation and delays. The figures for Europe therefore confirm the global trend of a strong focus on projects and investments in cell production. The goal of locating 30% of global cell production on European soil could be achieved."

However, Neef adds that Europe is likely to remain weak in the production of anode materials and will have to rely on imports. Other gaps also continue to exist, e.g., in passive cell components or the key technology of lithium iron phosphate, which is extremely important for low-cost batteries.

So far, the expansion of production capacities and the question which manufacturers could cover this technology in cell production remains unclear. Similarly, no material manufacturer has yet committed to building significant capacity for silicon materials, which are considered to be the next generation of LIB technology.

To overcome these challenges, investments and good investment conditions, but also low energy costs and qualified workers play an important role. Streamlining bureaucratic processes and reducing time-consuming procedures, as well as improving government subsidies and financing mechanisms could help to attract more industrial players and ensure a level playing field with non-European countries.

More information: Lithium-Ion Battery Roadmap—Industrialization Perspectives Toward 2030. www.isi.fraunhofer.de/content/ … LIB-Roadmap-2023.pdf